2024 Schedule C Form Instructions – However, a Schedule C form is required to report your businesses profits and losses. When you decide to close your sole proprietorship, there are no special instructions to follow, except what is . Fill out Schedule C per the instructions provided by the IRS. Record your net profit on line 31. Transfer this figure to line 12 on Form 1040. Be sure to keep proper records of all your .

2024 Schedule C Form Instructions

Source : www.irs.govHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comSchedule c form: Fill out & sign online | DocHub

Filing a Schedule C For An LLC | H&R Block

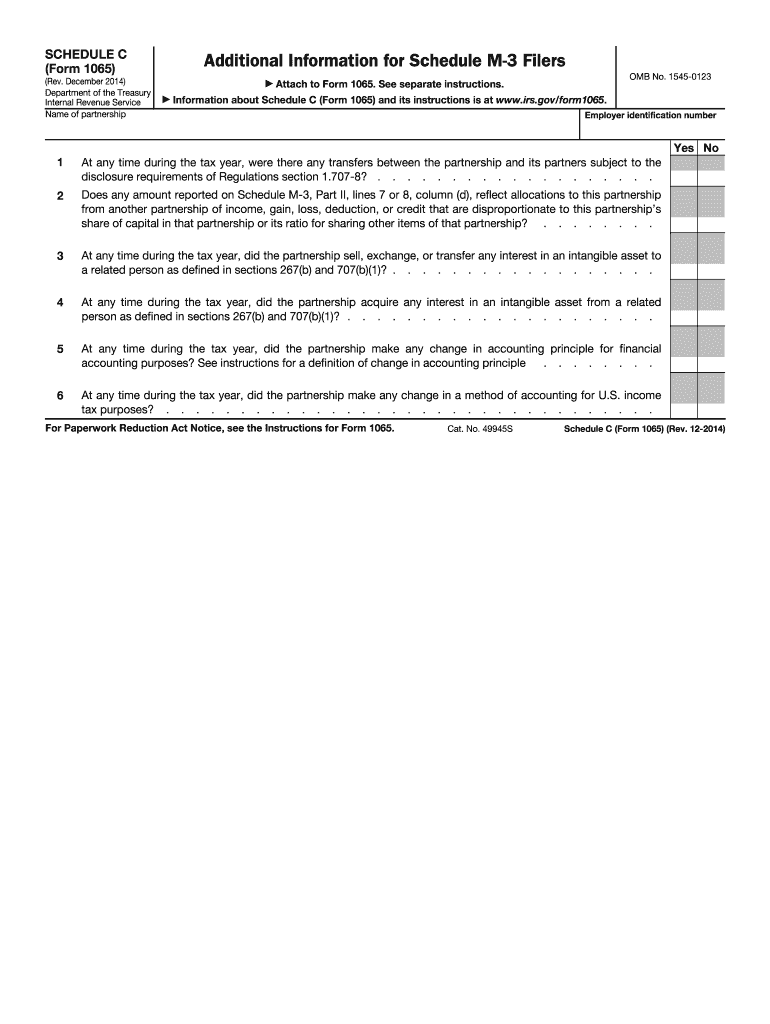

Source : www.hrblock.com1065 schedule c: Fill out & sign online | DocHub

Source : www.dochub.comFiling a Schedule C For An LLC | H&R Block

Source : www.hrblock.com2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Source : instruction-schedule-c.pdffiller.comSchedule C Form 1040 Sole proprietor, independent contractor, LLC

Source : m.youtube.com2024 Schedule C Form Instructions 2023 Instructions for Schedule C: The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 . As mentioned, FreeTaxUSA is one of two online tax prep apps that lets you fill out a Schedule C form for free Still, if you follow the site’s instructions carefully and use its help .

]]>